When Your Home Sale Won't Cover All Debts

Reader Question: I purchased my home in the summer of 2021 for $400,000. To help with my interest rate, my folks took out a home equity loan for $80,000. I need to sell my home, and I'm unlikely to be able to pay off my parents' loan. Otherwise, I would do a short sale. The idea of being in debt after selling the home, and having poured in cash without denting the principal, is heartbreaking to me. I'm a single woman and have put all my money into the interest for the last 5 years. How would you proceed?

Monty's Answer: You are not alone. Many buyers who purchased near the top of the market in early 2021 have been living with little to no equity since. Your situation is complicated by the fact that the $80,000 home equity loan is in your parents' names. While the money benefited your purchase, it's legally a separate loan for which your parents are responsible, unless you've agreed otherwise.

A Practical Way to View Your Options:

No. 1: Establish the real numbers. Before making a decision, you need a clear understanding of your home's current market value, net sale proceeds, and debt payoff requirements. Visit three large home portals and enter your address. You will get three different valuations. If you have the time, consider using a for-sale-by-owner (FSBO) portal to reduce a significant portion of your selling costs. Compare projected sale prices, closing costs, and your mortgage payoff both ways. You will have a current estimate of what would be left (or owed).

No. 2: Understand the legal responsibility for the $80,000. If your parents took out the home equity loan in their names, they are the borrowers, not you. If you inform them that you cannot repay it after the sale, the legal obligation to repay remains with them. This loan doesn't erase the emotional commitment you may feel, but it clarifies the financial stakes and helps you make informed decisions.

No. 3: Explore avoiding a short sale. A short sale can damage your credit and requires lender approval. If the market value is close to your total debt, you may be able to negotiate with your primary lender to reduce fees or accept a slightly lower payoff if it avoids foreclosure.

No. 4: Discuss openly with your parents. Because the $80,000 loan is in their name, your parents' perspective is essential. They may be willing to restructure the repayment, forgive part of it or defer repayment until you can recover financially.

No. 5: Consider renting as a bridge. If your home's value is still too low, rent it out for a few years to cover the mortgage (or most of it) until the market improves. Converting to a rental can preserve your credit and avoid leaving a large unpaid balance. However, being a landlord brings risks and responsibilities.

No. 6: Weigh the emotional and financial trade-offs. Carrying debt for years can be stressful but so can walking away and damaging your credit. Decide whether preserving your credit and avoiding legal entanglements with your parents outweighs the benefit of an immediate exit.

Finally

Gather the facts, determine where you are today, and include your parents in the discussion. With a complete picture and open communication, you can now choose the obvious path.

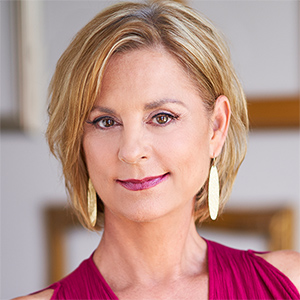

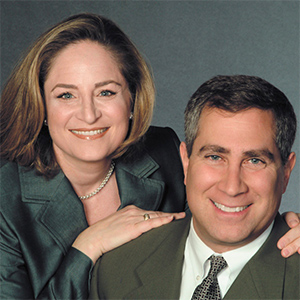

Richard Montgomery is a syndicated columnist, published author, retired real estate executive, serial entrepreneur and the founder of DearMonty.com and PropBox, Inc. He provides consumers with options to real estate issues. Follow him on Twitter (X) @montgomRM or DearMonty.com.

----

Copyright 2025 Creators Syndicate, Inc.

Comments