Allison Schrager: How can an economy this good feel this bad?

Published in Op Eds

On paper, these are good times for the U.S. economy. The latest GDP numbers show growth was at 3.3% in the second quarter. Business investment is up. The unemployment rate remains low, and the inflation rate is reasonable.

Still, underneath it all lies a nagging question: If the economy is so good, why does it feel so bad?

First, the numbers. Nominal GDP has grown more than 50% since the bottom of the last recession in 2020 — an annualized quarterly growth rate that’s more than 7%. Real median wages are up 5% since 2022, after failing to keep up with inflation in previous years. Unemployment has remained at about 4.5% since 2021 — and for much of that time, there was a worker shortage and a labor market that was very dynamic. Oh yeah, and there’s the stock market: The S&P is up more than 140% from the end of the recession. Finally, American consumers went into this boom in good shape, with balance sheets healthier than they’d been in decades.

And yet. This boom has always felt kind of terrible. For years, there has been a lot of chatter about how bad things were — remember the “vibecession” of 2022? This just might be the worst best boom ever.

Certain things have made this boom different from all other booms. First was the return of inflation. After being dormant for nearly 40 years, inflation came roaring back in 2021. In the first few years of the boom, many Americans did experience a real wage cut — and even now, real wages are not as high as they were in 2020.

Inflation may be lower now, but it is still higher than what Americans were used to, and the price levels are higher. Inflation also introduces more uncertainty. At first, people expected inflation would end in a recession, because that’s normally what happens — either from the Federal Reserve increasing rates or from inflation itself causing harm. But inflation went down and the recession never came.

But what about that uncertainty? It’s not only because of inflation. Some of it stems from big structural changes in the economy — and all else being equal, uncertainty makes people feel worse off. AI has emerged as a new force in the economy, increasing the value of the stock market but changing the nature of work and threatening to eliminate jobs. The introduction of tariffs and the transformation of the global trading order could increase prices and make the economy less stable.

Then there is the natural human bias to be negative. Throughout this boom, surveys have shown that people feel good about their own economic situation, but view the overall economy as terrible. There is also a political layer, with more Americans viewing the economy through a partisan lens. If their preferred party is not in power, they tend to have less confidence in the economy.

Finally, there are some legitimately bad numbers — as any economist can tell you, there is always bad news if you know where to look. Long-term interest rates are higher (and, I might add, they’re not coming down). There are signs of rising inflation and a worsening labor market. Young men, especially recent college graduates, aren’t finding jobs, and fewer firms are hiring. Housing affordability is a big problem, especially with higher interest rates, and the housing shortage makes the economy less resilient and dynamic. Some investors are concerned that this booming stock market is starting to look frothy, and there are debt vulnerabilities brewing in the financial sector. Consumers have mostly spent all the stimulus money they got during the pandemic and are starting to get back into debt. Defaults are rising.

These could all be signs that a recession is coming. At the same time, to state the obvious, it is impossible to know what the future holds. One thing economists do know is that booms don’t die of old age — it’s usually a homicide, in the form of a big economic shock, often in debt markets. The current state of the economy can’t predict whether a shock is coming, but it’s a good indicator of whether a shock can be withstood. And the current U.S. economy, while still booming, is looking more vulnerable than it did just a few quarters ago.

This has been a legitimately strange boom. It felt bad initially because inflation did some economic damage, and it feels bad now because some important indicators are getting worse. But none of this means the U.S. is heading for a recession, never mind a depression. It may be that the U.S. economy is coalescing around a new normal, with higher inflation and interest rates, and that just feels weird.

_____

This column reflects the personal views of the author and does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

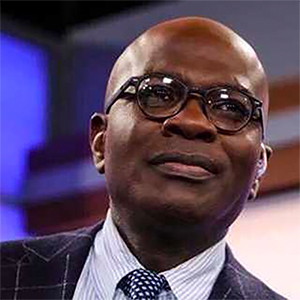

Allison Schrager is a Bloomberg Opinion columnist covering economics. A senior fellow at the Manhattan Institute, she is author of “An Economist Walks Into a Brothel: And Other Unexpected Places to Understand Risk.”

_____

©2025 Bloomberg L.P. Visit bloomberg.com/opinion. Distributed by Tribune Content Agency, LLC.

Comments